Mission

School of Social Sciences, Humanities, and Arts' Office of Financial Services is committed to providing responsive financial management support, fiscal guidance, and excellent service to the dean, faculty, staff, and students. Our goal is to ensure responsible and accountable stewardship of financial resources. The services we provide include: funds management and reporting, travel reimbursements, payroll management, and day-to-day operational support.

Policies & Support Materials

- Payroll Time Reporting System (campuswide)

- Business and Financial Forms

- Business & Finance Bulletin BUS 79 - Expenditures for Business Meetings, Entertainment, and Other Occasions

- Business & Finance Policy G41 - Employee Non-Cash Awards and Other Gifts

- Business & Finance Policy G42 - Gifts Presented to Non-Employees on Behalf of the University

SSHA Internal Forms

- SSHA Dean's Funding Request Form

- Faculty Startup Extension Request Form

- SSHA SPOT Program Nomination Form

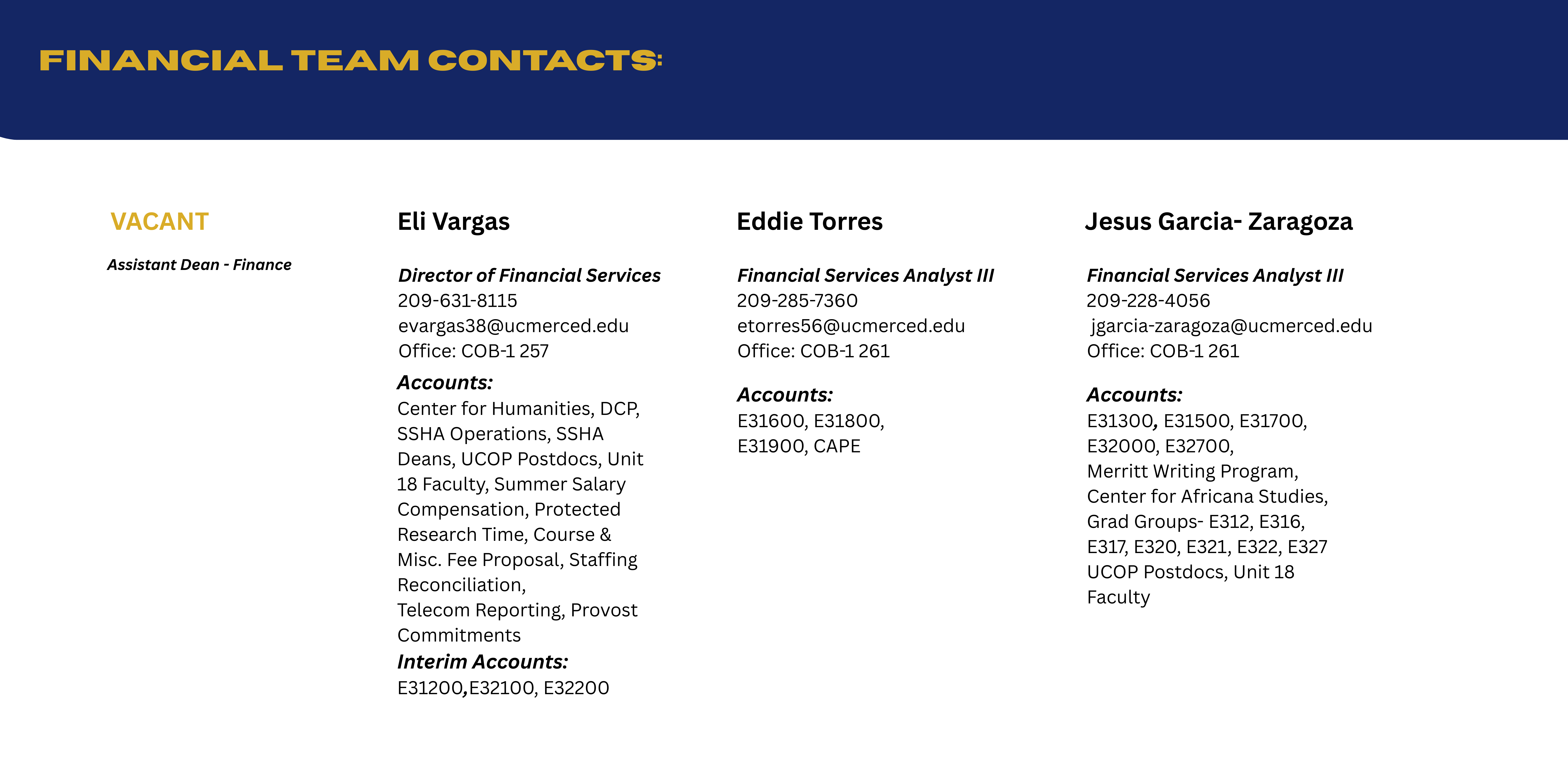

For inquiries, please email SSHA Financial Services at: ssha.financial@ucmerced.edu